why are reits tax efficient

Tax rates on dividend distributions from the REIT. Tax-Efficient Investing Strategies.

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

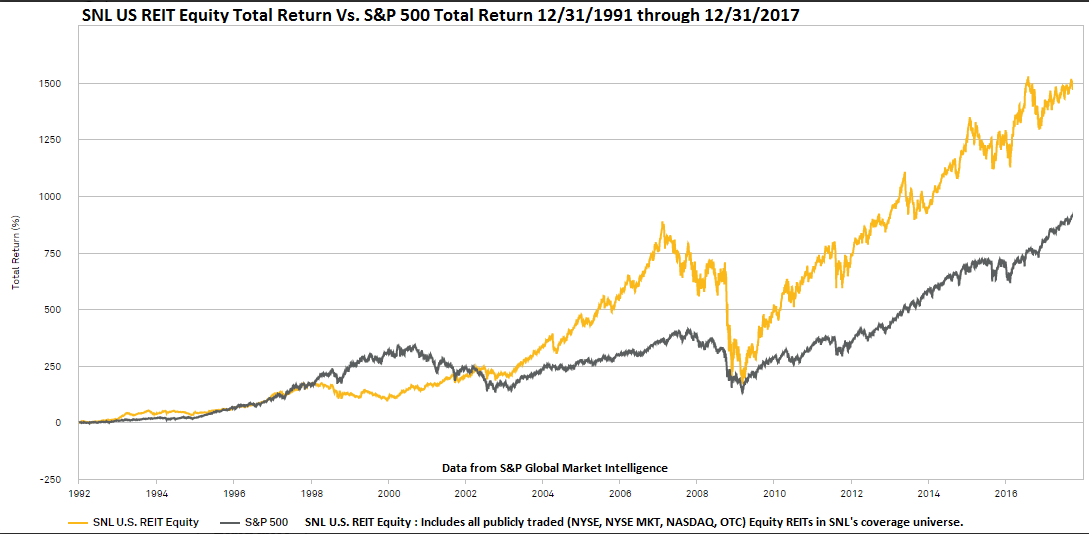

While REITs are less tax efficient than qualified dividend-paying US equities the extent of their inefficiency is overstated and misunderstood.

. Visit The Official Edward Jones Site. Tax Efficiency By holding a REIT in my Roth I can lower my tax rate on REIT income from 24 to 0. The system doesnt work so smoothly for all ETFs.

We Advise More REITs than Any Other Professional Services Firm. Tax-advantaged accounts like IRAs and 401 ks have annual contribution limits. REITs are a tax-efficient diversified alternative to direct real estate ownership and investment.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes Moments. Why are REITs tax efficient. The Tax Cuts and Jobs Act TCJA passed into law in 2017 further enhanced the tax efficiency.

Their dividend tax rate is much higher than dividends on stocks. Fixed-income ETFs which have more turnover and often have cash-based creations and redemptions are less tax efficient than their equity. Real Estate Investment Trusts REITs are known as a tax efficient way to invest in real estate.

For 2021 and 2022 you can contribute a total of 6000 to your. REITs pay out roughly 65 of their distributions. Rather than having to buy and maintain actual physical real estate properties investors can.

Potential Market Inefficiency Due to the weird legal structure of. An analysis of Burton G. REITs offer incredible tax advantages.

Tax rates include both federal and state tax rates and are based on the typical tax bracket of Wealthfront clients. Shareholders may then enjoy preferential US. REITs are a tax-efficient diversified alternative to direct real estate ownership and investment.

Theres another reason to put REITs in tax-advantaged accounts. Malkiel of Wealthfront found that the. Ad 5 Reasons Why We Think You Should Get Into Real Estate Investment Trusts.

Theres another reason to put REITs in tax-advantaged accounts. 2 Investors should be aware that a REITs. Regarding the tax efficiency of REITs I think its worthwhile to point out that while they arent as tax efficient as stock index funds they are far more efficient than taxable bonds.

Ad Fisher Investments has 40 years of helping thousands of investors and their families. Understand the different types of trusts and what that means for your investments. Wish You Could Invest in the Lucrative Real Estate Market.

REITs are a tax-efficient diversified alternative to direct real estate ownership and investment. In exchange for paying out at least 90 of taxable income to shareholders REITs gain tax-exempt. Dividends are assumed to be.

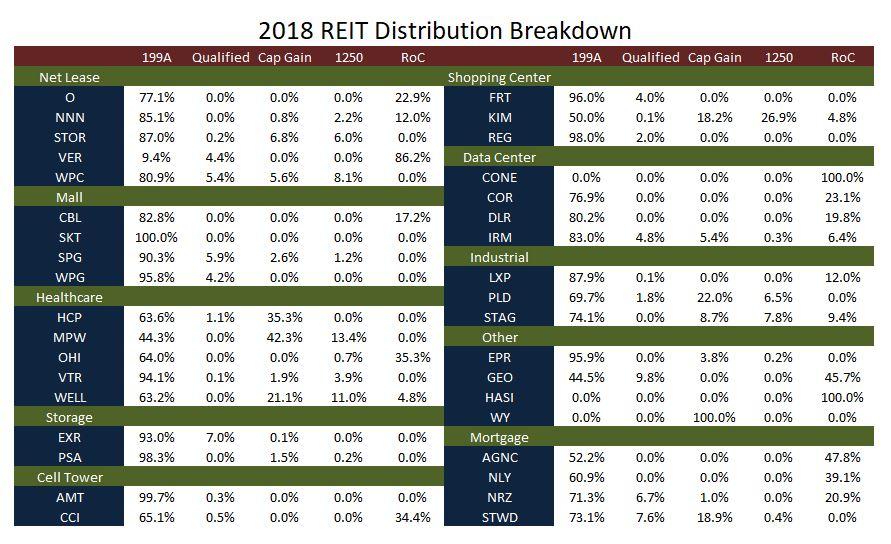

Since REITs are required to distribute 90 of their annual taxable income to investors REITs are allowed to avoid taxation. ROC is a tax designation which considers taxable income after non-cash tax accounting adjustments such as depreciation and amortization. These REITs are Under 49.

New Look At Your Financial Strategy.

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

5 Reasons To Own Reits Real Estate Investment Trusts Anytime And Especially Now Seeking Alpha

How Tax Efficient Are Your Reits Seeking Alpha

Advantages Of Reits In A Taxable Account Seeking Alpha

Reits Offer Retirement Income And Much More This Retirement Life Investing For Retirement Retirement Portfolio Real Estate Investment Trust

Sec 199a And Subchapter M Rics Vs Reits

Guide To Reits Reit Tax Advantages More

A Short Lesson On Reit Taxation

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

Tax Aspects Of Investing In Reits And Remics The Cpa Journal

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

Pin By Rcs On Investor Awareness Words Of Wisdom Words Wisdom

Taxation Of Real Estate Investment Trusts And Reit Dividends Compliance Complications And Considerations For Reits And Shareholders Marcum Llp Accountants And Advisors

Reits Vs Real Estate Mutual Funds What S The Difference

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

Guide To Reits Reit Tax Advantages More